Learn the eligibility conditions and the procedure for making an application for home financing in the near order of 100k.

- Expert Articles

- First time Buyers

This guide will provide you with every piece of information you must know together with exactly how much deposit you may need, the minimum earnings required by loan providers together with procedure for using to have a mortgage for 100k.

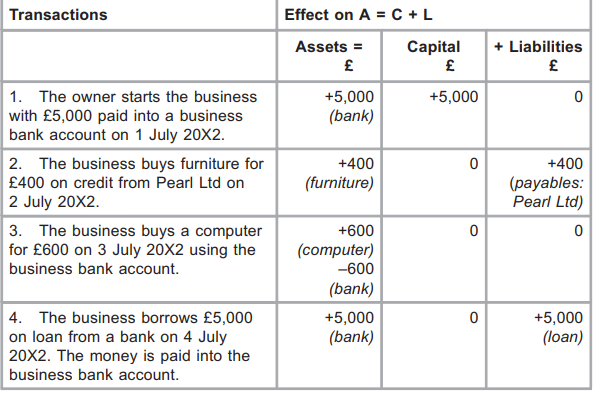

How much cash earnings must i score a home loan to own ?100,000?

If you are applying for a just home loan and you need to use ?100,000, your own financial will need to look for evidence of your cost so you’re able to determine whether they are able to make danger of financing for you.

All of the financial has their particular regulations regarding choosing exactly why are an excellent debtor and this whom they will lend in order to and you will under just what conditions.

The sort of employment you’ve got we.e. whether you’re inside the a secure bargain or try has just mind-operating otherwise to your furlough

Just how much should i earn a-year to get a ?100,000 financial on my own?

Your own annual income would be a big basis when it comes of getting approved to possess a home loan and more than loan providers assess exactly how far they could provide your playing with money multiples of cuatro.5 x their annual money.

The typical paycheck in the uk from inside the 2020 are ?29,600 annually, thus considering this, a typical bank you’ll commit to lend you ?133,200, dependent on the conditions which its cravings so you’re able to provide so you can some body along with your products.

Something you should watch out for is the fact some loan providers get concur so you can financing large income multiples if they feel the mortgage was affordable to you, regardless of if a significant money and you may a reduced loans so you can earnings ratio would likely be required for it.

Also, additionally, it may end up being the situation that your chosen bank agrees to agree your own home loan underneath the contract that they explore down income multiples so you’re able to estimate your loan matter.

This is because they keeps tightened up the credit requirements during the white of your own less costly aftereffects of Coronavirus, otherwise it can be as you has bad credit otherwise lowest affordability.

Some lenders can also provides minimal annual money requirements too, although not, if the a loan provider performed invest in lend you 4 x your yearly earnings and you won ?twenty-five,000 per year, it could be you are able to to find home financing for ?100,000.

Should i score a shared financial getting ?100,000?

If you’re providing a shared home loan, both having a family member, lover or friend, it’s quite common, and that you can, to make use of both of your income toward financial app. This might allows you to fulfill cost requirements for down interest finance, borrow more and probably supply loans which have a higher-loan-to-well worth.

How much put would I want for good ?100,000 financial in the uk?

To own a home well worth ?115,000, good 15% put might possibly be ?17,250, which will signify you could get home financing for ?100,000 and also have ?dos,250 remaining having decorating the house or property.

not, in a number of situations which have low value otherwise poor credit, it could be the situation that a loan provider just agrees in order to less LTV price and that asks you to have a higher put.

In the event the for example, a lender desired a deposit off twenty-five% of the house worth and also you desired to get that same family cherished within ?115,000, might you desire ?.

A selling point of that is that you’d getting borrowing from the bank quicker as with the greater deposit, you would just need money having ?86,250.

How come the level of personal debt I have apply at my software?

Loans so you can money proportion try determined adding enhance month-to-month financial obligation payments and breaking up them by your month-to-month money. A high DTI proportion ways lowest value so it will likely be more complicated shopping for a loan provider willing to accept a mortgage that have the absolute most preferred terms.

Thank goodness that there exists pro lenders that are much more regularly credit so you can applicants in financial trouble in addition they normally be more available to giving a software if their other requirements was satisfied.

Working with a large financial company can help select these firms quickly, without the problems from looking several testing web sites.

Is a brokerage help me get approved getting an effective ?100k financial?

A home loan professional also can negotiate the fresh regards to your own home loan and employ their sense to eliminate you against to make problems to the the application that will hamper your money later on in the future.

Examining new small print regarding agreements is just one of many tasks bad credit personal loans Texas which our agents manage as they can and evaluate hundreds of British loan providers, showing those who feel the most favorable cost and are usually more likely to approve your.

Get in touch with a large financial company from the an effective ?100k mortgage

Our team is found on hands to respond to the questions you have on how discover a mortgage to possess ?100,000 or other matter that you are curious about. You will be welcome to have fun with our very own financial calculator to own an instant offer however, talking-to our team is the best method of getting a bid that all correctly reflects your needs. Label 02380 980304 otherwise have fun with our very own contact form to let united states learn about their plans to get property.