Material

Multiple concerns off mortgage organizations inside 45 months are labeled and you can measured since a single inquiry, and that decreases the latest affect your credit score.

In this post, I am going to assist you ways to use the latest 45-big date screen to find pre-acknowledged with the mortgage and buy the lower speed instead of crushing your credit rating.

Do taking pre-acknowledged damage my personal borrowing?

If you get pre-accepted to own home financing, the financial institution monitors your own borrowing to review your credit score and you will rating. The financing have a look at are good “hard inquiry,” that temporarily lower your credit rating because of the several items.

Homeowners is always to prevent searching for a home loan rates on the pre-acceptance stage. You can simply lock the borrowed funds rates if you have a great possessions target. On the other hand, you aren’t forced to make use of the lender that pre-approves your home loan, and you may key lenders if you learn one offering ideal terminology.

As an alternative, focus on deciding on the best bank and you may realtor. Which have positives at the straight back who will go the extra mile could possibly be the difference between a rejected and you can recognized bring.

Earliest, like a neighbor hood lending company, such as for example NewCastle Home loans, and now have a verified pre-recognition letter upfront domestic query. 2nd, get a talented agent to help you handle your case and provide the new agent a copy of your own letter.

While pre-acknowledged, you’re going to be from inside the good updates and then make an offer to the a house after you choose one you like.

Committed it will take locate a house to find normally differ somewhat of the grapevine and you may utilizes of numerous items, such as the local housing industry as well as your personal preferences. This is why, you household apparently quickly or take a few months to get suitable property.

Initiate seeking a mortgage if you’re “significantly less than bargain” to invest in a property. Significantly less than offer means you made a deal for the assets, as well as the seller approved it bank personal loans Oklahoma.

When you find yourself under deal, the new income possess but really become signed, and there is tend to contingencies or any other conditions that have to be met before deal can also be close.

With respect to the sales deal terms, you normally have 15 to help you 60 days to close off. This provides you for you personally to complete homework towards the assets, such a lawyer review, a house evaluation, and in search of a home loan.

How to search for a mortgage?

Purchasing home financing, research and examine has the benefit of of a number of loan providers to obtain the top mortgage for your needs. Here are a few methods to follow along with when shopping for a mortgage:

- Discover a reliable mortgage lender. Start by the financial institution you to definitely performed the mortgage pre-approval letter. 2nd, request a suggestion regarding members of the family, family unit members, and you may coworkers which has just bought a home. Then, speak to your real estate professional because agents usually work on lenders. Then, research on the web evaluations and recommendations from lenders you’re interested in to know its profile and customer support.

- Inquire about a proper Loan Estimate. Query a number of mortgage lenders for a loan Guess to buy for home financing. The borrowed funds Guess was a standard form you to definitely contours important info regarding financing, such as the interest, monthly installments, closing costs, or any other charges. Looking at the borrowed funds Guess very carefully and you will comparing they together with other also offers away from various other lenders to make certain you’re going to get an educated offer it is possible to.

- Lock the interest rate. Financial prices appear to vary, thus providing Loan Rates for a passing fancy time is a good idea. Upcoming, once you have discovered a lender and you may financial device you might be comfortable with, protect your interest to protect against abrupt grows just before closure on your own new house.

- Mortgage Estimate Explainer

- See NewCastle’s Bing analysis.

Would lenders consider borrowing just before delivering a loan Imagine?

The lending company need look at your borrowing from the bank in advance of giving you a loan Imagine to evaluate your own creditworthiness and see the mortgage words you could possibly get qualify for.

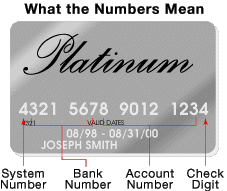

Your credit rating and you will credit history bring details about your own percentage background, outstanding loans, and complete economic stability. This article decides the interest rate or any other loan terms, such as the amount borrowed, downpayment, and you will closing costs.

Additionally, the financial institution is required legally to offer an effective Loan Imagine that correctly reflects the costs of your mortgage, which means particular details about your creditworthiness.

Manage several concerns out-of mortgage lenders harm my personal credit?

When you look at the forty five-big date “rate shopping” period, the financing bureaus realize that you happen to be rates-wanting an informed mortgage package, so they class questions once the an individual query.

That way, you might look for an educated financial package without having to worry throughout the the fresh negative impression from numerous borrowing questions in your credit scores.

In search of a home loan price is still worth it forty-five or a whole lot more days following the basic credit check. Simply because the great benefits of less financial interest and you will loan will set you back fundamentally provide more benefits than the result on the credit score about price looking.

What’s the difference in a painful and you will mellow credit assessment to own a home loan?

The difference between a hard and delicate credit check getting an effective home loan is the affect your credit score and also the purpose whereby they are utilized.

- A flaccid credit check doesn’t impact your credit rating. Loan providers fool around with flaccid borrowing monitors getting records and borrowing overseeing functions. Whenever a lender otherwise collector performs a softer credit score assessment, they merely remark a restricted percentage of your credit history, like your credit rating otherwise percentage background.

- A difficult credit check, called an arduous pull, are a cards inquiry which can impact your credit score. Lenders otherwise creditors usually have fun with difficult borrowing from the bank monitors after you implement for borrowing, like home financing, charge card, or consumer loan. When a loan provider otherwise creditor work a challenging credit assessment, it remark the complete credit history, including your credit history, payment record, and you will credit rating.

NewCastle Lenders performs an arduous credit score assessment included in this new verified pre-approval procedure. We very carefully review the credit and you may financial history to provide the strongest pre-acceptance page – finalized because of the our authoritative financial underwriters. A proven mortgage pre-approval letter, supported from the mortgage choice maker, boosts the opportunities you can winnings the deal, specially when fighting together with other consumers.

It’s worth detailing that not the borrowing from the bank questions is addressed the latest same manner. Instance, credit card and personal loan questions could possibly get notably impression your own borrowing from the bank rating more than financial pre-approval issues. Therefore, it’s essentially best to stop opening brand new credit cards otherwise getting away funds almost every other while preparing purchasing a house, as numerous credit inspections can reduce your get.