Skills USDA Home Mortgage Fl

The fresh new USDA Domestic Financing Fl facilitate those with a decreased-to-modest income get a home from inside the rural areas. It’s got a reasonable answer to individual a house once you might not get a consistent mortgage.

To get a USDA Home Financing for the Fl, your pertain with a lender that USDA approves. These firms concentrate on USDA financing. They direct you through the entire process, making it simpler.

Once you incorporate, you will want to tell you just how much you earn, your lender info, and you will where you work. The financial institution talks about them to see if your qualify for the mortgage.

Once you apply, the lender monitors the borrowing and other information. They determine whether you can purchase the loan. In this case, it make it easier to finalize new loan’s facts.

USDA funds features specific legislation. Particularly, the home we want to buy should be in a rural town that’s acknowledged. Plus, the latest USDA and its own loan providers put the mortgage dimensions and you will focus rate.

Eligibility to have USDA Household Mortgage Fl

Discover an effective USDA Family Financing into the Fl, you must see put earnings limits. This type of will vary by the assets location and you will house dimensions. Together with, the property you need need to be in the an effective USDA-outlined rural urban area.

Income limitations towards USDA loan inside Fl rely on domestic proportions and you may condition. Contemplate, these types of limits up-date annual. Check the new restrictions before applying.

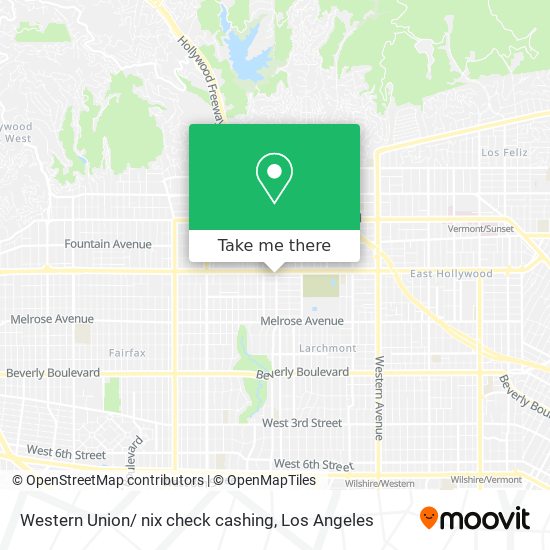

The fresh USDA financing chart to own Fl suggests where properties get USDA fund. They scratching the fresh new eligible outlying areas. Make sure the possessions you are considering is during among such portion by checking the latest chart.

For individuals who match the money and you https://paydayloansconnecticut.com/branchville/ may possessions location laws and regulations, you can find an excellent USDA Home Financing for the Florida. Talk to a medication USDA bank for the Fl. They can help you discover for those who meet the requirements and you can make suggestions through the application.

Gain confidence for the a simplistic application process that have custom guidelines and clear communication. Unlock the newest tips for homeownership possibilities now! Contact Brad at the (904) 263-0376 for a totally free initially session.

Standards getting USDA Domestic Financing Florida

To locate an excellent USDA Home Financing inside the Fl, you can find very important standards to meet up with. It show in the event that a borrower will pay straight back the mortgage. This is what you must know:

step one. Steady Money

Proving a steady earnings is essential. It needs to be sufficient to your loan’s monthly installments. USDA lenders for the Florida will with the simply how much you earn to find out if your fit the advice.

2. Capacity to Repay

Consumers need to prove they could repay the mortgage. It means lenders have a tendency to verify that your earnings talks about the money you owe as well as the financial as well.

3. Appropriate Credit score

That have a good credit score is key to bringing that loan. Lenders commonly test out your credit file. They’ll look at your commission history and you can score.

USDA House loans in the Fl have place loan limits and you will cost. Its critical to satisfy all the requirements to view so it financing sorts of.

Finding the right financial is a must for a good USDA Family Loan from inside the Florida. Come across loan providers that focus on such finance. They know how to handle the method well.

The fresh USDA will bring a listing of recognized loan providers on its webpages. Which checklist makes it possible to select an experienced financial during the Fl.

Like a lender having know-just how inside the USDA funds and you may good customer support. Working with a supporting financial is important having a smooth process.

Great things about USDA Mortgage loans

USDA Mortgage loans when you look at the Florida help people with ease become people. They make to order a house far more obtainable of the maybe not requiring an effective deposit. This program facilitate someone realize its think of home ownership in the sun Condition.